For Companies

The most powerful tool available, to help you determine whether your company must report, and if so, who are its Beneficial Owners required to report Beneficial Ownership Information (or BOI).

What is This All About?

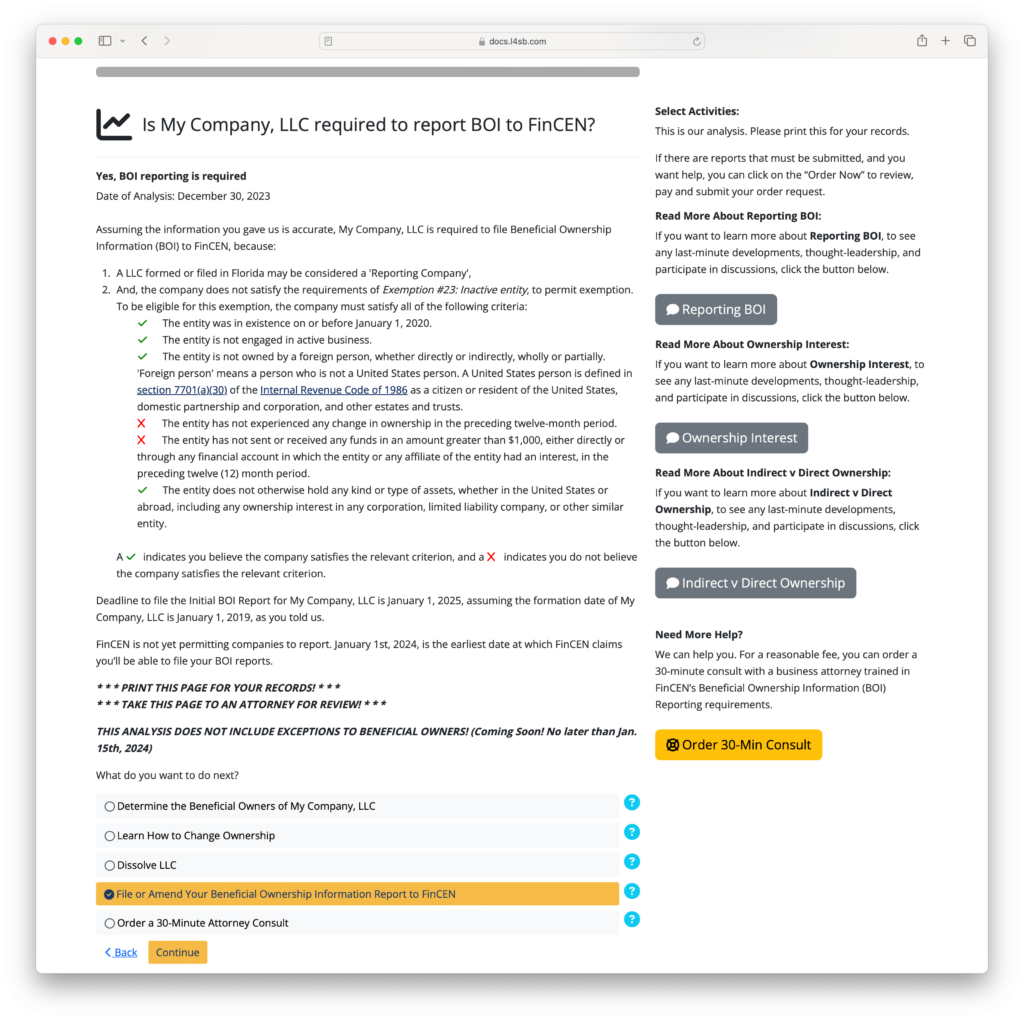

There are exceptions, with very specific (hard to meet) requirements, for large companies, inactive companies, and more. Most small companies will have to report BOI to FinCEN with tight deadlines, with heavy fines and criminal sanctions if you file false information or miss the deadlines.

BOI is personally identifying information about a company and the individuals who directly or indirectly own or control a "reporting company". This information includes name, date of birth, residential address, and an acceptable form of ID.

FinCEN will permit Federal, State, local, and Tribal officials, as well as certain foreign officials who submit a request through a U.S. Federal government agency, to obtain Beneficial Ownership Information (BOI) for authorized activities related to national security, intelligence, and law enforcement. Others can gain access with your permission.

All new companies formed on 1/1/2024 or after, have to submit an initial report within 90 days of formation. All other companies formed prior to 1/1/2024 have until 1/1/2025 to submit their initial report. All companies have to submit updated reports within 30 days after a change in circumstances of the company, a Beneficial Owner, or an ID expires of one of the Beneficial Owners.

Beneficial Owners are individuals who directly or indirectly own or control 25% or more of a reporting company, as well as individuals who are considered in "substantial control" over a reporting company. Non-individuals (i.e. trusts, other companies, other entities) who have ownership or control over a reporting company have individuals associated with them, who can be deemed to have indirect ownership or control over the reporting company.

You should really hire an attorney to help you, because the penalties for not reporting and updating Beneficial Ownership Information is so severe. Our expert system is the next best thing, although it was written to help attorneys as well as company owners. It's free, anonymous and takes 3-5 or 5-10 minutes, depending on the question you want answered. It is also flexible, designed to work with simple and complex corporate setups.

Have More Questions?

We're posting updated information all the time, and post many articles that do a deep-dive into the latest issues.

You can also post comments (moderated) in our blog, although the Discussions is a better area for Q&A.

We have a moderated Q&A Forum (called the Discussions). Anyone can submit a Question, although we only permit licensed attorneys and verified subject-matter experts to Answer questions. This helps ensure high-quality and professional responses.